Tax-Free Retirement Strategy

WITH PERMANENT LIFE INSURANCE

1- Provide an income tax-free death benefit for the people who depend on you.

2- Defer taxes as you accumulated cash value grows.

3- Potentially access that cash value using income tax-free policy loans and withdrawals, to use for retirement income or other needs

Strategies to Save For Retirement

EXAMPLES

After Tax

Pre-Tax

Tax-Free

Private Savings i.e. CD

Traditional IRA

Qualified Plans 401(K) & 403(b)

Roth IRA

Permanent Life Insurance

- After Tax Strategy – when you set aside a portion of your after tax income into an account earmarked for retirement. Taxes are paid annually on any earnings. An example of this type of savings is a Certificate of Deposit.

- Tax-Deferred Strategy – when you set aside a portion of your after tax income for retirement, earnings on the account grow tax-deferred. When retirement income is taken, taxes are due on the tax-deffered gain. A Non-Deductible IRA or annuity is an example of this type of savings.

- Pre-Tax Strategy – might include an Employer sponsored qualified plan, like a 401(k) and 403(b) plan. You don’t pay current taxes on contributions made to the plan and earnings grow tax-deffered. Later when you take retirement income the benefits are income taxable.

- Tax-Free Strategy – is similar to the Tax-Deferred Strategy: you set aside a portion of your after tax income, and earnings grow tax-deferred. Retirement income is received income tax free. A Roth IRA is an example of this type of savings. Another type of finiancial vehicle is permanent life insurance.

Permanent Life Insurance Provides

- Income tax-free death benefit

- Tax-deferred build-up of cash value

- Potential for tax-free retirement income

Tax-Free Retirement Strategy

Using Permanent Life Insurance

Additinal Benefits of Permanent Life Insurance

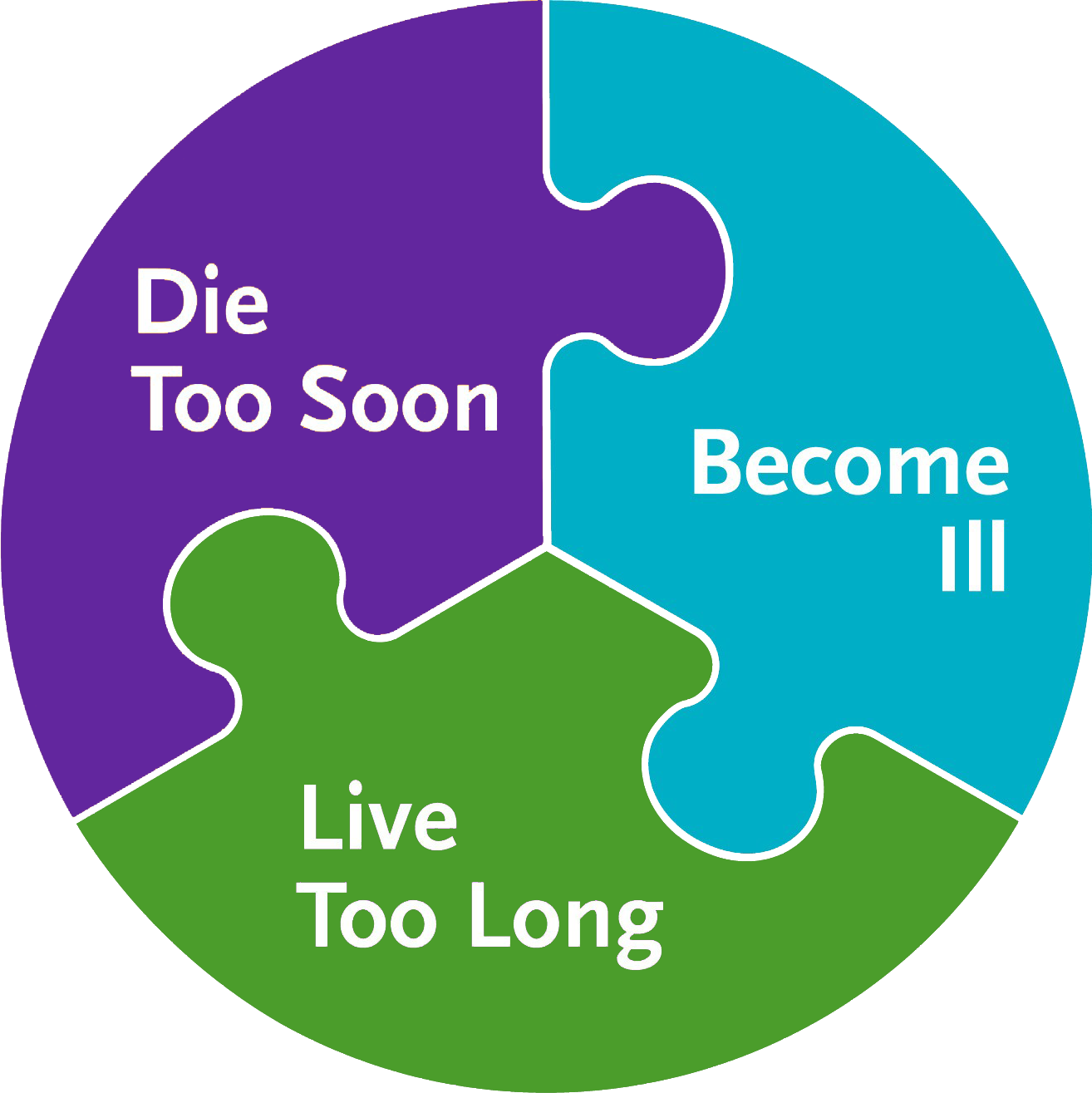

Self completing

In the event of premature death, the income tax-free death benefit would help fund your spouse’s retirement goals.

Access to funds in the event of illness

Accelerated Benefit Riders are availableat no additional cost and may allow you to access all or a part of your death benefit to help pay for costs associated with a terminal, chronic or critical illness.